Author: Chee Wen Jun

Date: 08.Jan.2026

What Budget 2026 Means for Home Buyers: Key Changes You Should Know

Budget 2026 introduces several important measures aimed at improving housing affordability and supporting Malaysians in their journey towards home ownership. These initiatives benefit first-time homebuyers, young adults, gig workers, self-employed individuals, and civil servants.

1. Extended Stamp Duty Exemption For First-Time Homebuyers

The stamp duty exemption for first-time homebuyers purchasing residential properties priced at up to RM500,000 has been extended for a further two years, and will now remain in force until 31 December 2027.

The conditions that must be fulfilled are:-

1. The SPA is executed within 1 January 2026 and 31 December 2027.

2. The individual never owned any residential property including by inheritance, gift or joint ownership.

3. The purchaser is a Malaysian citizen.

4. The purchase price of the property is not more than RM500,000.00.

5. It is solely for the purchase of residential properties.

This exemption covers both the instrument of transfer and the loan agreement, significantly reducing upfront costs for eligible purchasers. The measure is intended to support Malaysians, particularly young and middle-income buyers, in securing their first home.

2. Higher Stamp Duty For Foreign Property Buyers

Foreign buyers, including non-citizens and foreign companies, will be subject to a fixed stamp duty of 8%, depending on the value of the property. Permanent residents are exempt from this higher rate and remain on tiered rates between 1% and 4%, while first-time Malaysian buyers continue to enjoy exemptions on homes valued up to RM 500,000 until the end of 2027.

1% – On the first RM100,000 of the price of the property

2% – Between RM100,001 and RM500,000

3% – Between RM500,001 to RM1 million

4% – Anything that is above RM1 million

Stamp Duty on Property Transfers for Malaysia Citizens

3. More Affordable Housing Units Being Built

The Government continues to expand the supply of affordable homes nationwide. Under Budget 2026, several major housing projects are being funded or completed:

- 49 Residensi Rakyat (PRR) projects, with 1,755 units expected to complete by end 2026

- 6,545 Rumah Mesra Rakyat (RMR) units completing by end 2026, benefiting more than 26,000 people

- 4,030 existing Residensi MADANI units to be completed in 2026, plus 5,981 new units starting in 2026

- 3,000 PR1MA homes expected to complete in 2026

These developments aim to help more Malaysians access affordable and quality homes.

4. Big Boost to Housing Loan Access Through SJKP

One of the most impactful measures for home buyers is the strengthening of the Skim Jaminan Kredit Perumahan (SJKP).

a) RM20 billion in guarantees for first-time home buyers

This guarantee is available even for applicants without fixed income, such as gig workers, freelancers and self-employed individuals.

b) Special RM1 billion allocation for contract government staff

Contract-of-service workers, including contract teachers and KEMAS staff, will receive additional support to secure their first home financing.

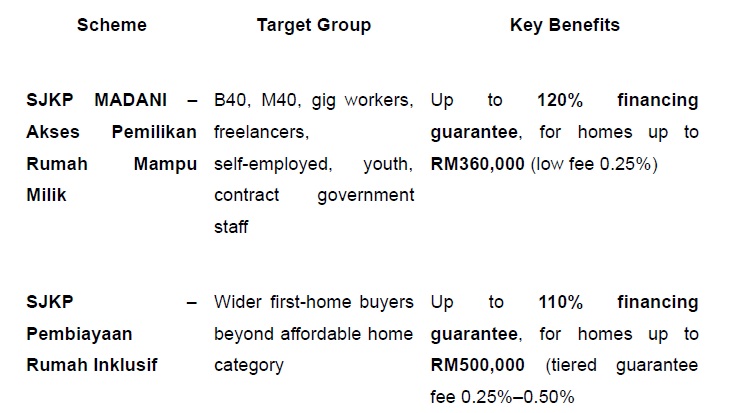

c) Two enhanced housing guarantee schemes

Eligibility of SJKP: –

1. Malaysian citizens aged 18 years and above. Joint financing is allowed

2. Non-fixed income earners, self employed and fixed income earner can apply

3. Purchase of first new residential house or existing house (sub-sale) or auctioned house to be owner occupied

4. Open to newly completed or under construction or sub-sale or auctioned residential property

5. The total repayment of all applicant’s loans does not exceed 65% of gross monthly income

6. CCRIS (Central Credit Reference Information System) record of arrears not more than 2 months within a period of 12 months

7. No other adverse credit records within the last 24 months

You can apply from the participating financial institutions only.

5. New Step-Up Financing for Young Home Buyers

Budget 2026 introduces a Step-Up Financing scheme to ease entry for young buyers aged 21 to 35.

- Backed by RM10 billion in government guarantees

- Lower monthly instalments during the first 5 years, making early ownership more affordable

- Available together with SJKP schemes for greater flexibility

6. Support for Strata Homeowners

Budget 2026 includes funds to improve living conditions for strata residents:

- RM106.3 million for maintenance of low and medium cost strata housing

- RM36.9 million for lift replacement and repairs under the Program Penyelenggaraan Perumahan Mampu Milik Berstrata

7. Housing Support for Civil Servants

Additional measures target government employees:

- BSN special housing financing of RM500 million for contract civil servants buying their first home

- LPPSA maximum financing limit increased to RM1 million from RM600,000, with easier second-loan approvals starting Q4 2026

- 2,586 new units under Program Perumahan Penjawat Awam Malaysia MADANI to be built, with some completed in 2026

Conclusion: Budget 2026 Continues to Prioritise Home Ownership

Budget 2026 reflects the government’s commitment to helping Malaysians to achieve the dream of owning a home, especially young adults, lower-income groups and those without fixed income. Whether you are a first-time buyer, a young professional, or someone with irregular income, these initiatives may significantly improve your chances of securing a home loan and entering the property market in 2026.

This article does not constitute legal advice or an expression of legal opinion and should not be relied upon as such. The information provided is for general informational purposes only. For further information, kindly contact us at nknp.adm@gmail.com. Readers are advised to seek independent professional advice before purchasing any property.